AMFI Registered Mutual Fund Distributors

89, Dr MGR Nagar, Thirumurugan Poondi, Avinashi

89, Dr MGR Nagar, Thirumurugan Poondi, Avinashi

If you’ve been following the news or checking your investment app lately, one thing is clear — the market is volatile. Prices are swinging up and down, headlines are alarming, and uncertainty seems to be everywhere.

Naturally, a common question arises:

“Market is volatile – should I start SIP now or wait?”

👉 What is SIP ?

This is one of the most important questions investors ask, especially beginners or those who recently started earning. The fear of “investing at the wrong time” is real — and completely understandable.

In this detailed, client-friendly guide, we’ll break everything down in simple language, without jargon, so you can make a confident and informed decision.

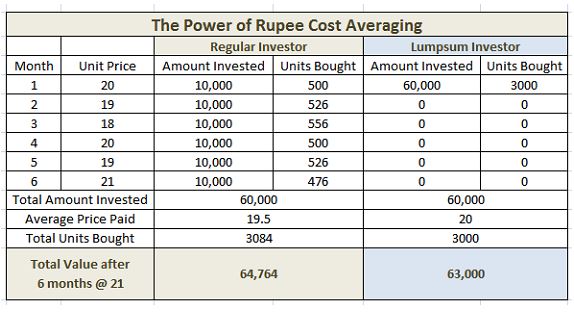

When markets are volatile, SIP shines because of rupee cost averaging

✔ You automatically buy more units when prices fall

✔ You buy fewer units when prices rise

✔ Over time, your average cost reduces

📌 Volatility actually helps SIP investors, not hurts them.

Many investors delay SIP thinking:

“I’ll start when markets fall”

“I’ll wait for stability”

The truth?

👉 No one can predict the perfect time.

Even experts get it wrong.

SIP removes timing risk by spreading investments across market cycles.

Volatile markets trigger emotions:

Fear during falls

Greed during rallies

SIP works like autopilot:

Fixed investment

Fixed date

Less emotional decision-making

This discipline is priceless.

When Starting SIP in a Volatile Market Makes Sense

You SHOULD start SIP now if:

✅ Your goal is 5 years or more

✅ You have stable income

✅ You want disciplined investing

✅ You understand short-term ups and downs

✅ You are investing for:

Retirement

Child’s education

Wealth creation

Financial freedom

Volatility becomes noise over long periods.

When You Should Be Cautious

You may delay or rethink SIP if:

❌ You need money within 1–2 years

❌ You don’t have an emergency fund

❌ Your income is unstable

❌ You panic during market falls

In such cases:

Build emergency savings first

Consider debt or hybrid funds

….

Yes, SIP is generally safer as it spreads risk over time.

Technically yes, but emotionally it’s better to continue if goals are long-term.

No, but it reduces timing and emotional risk significantly.

Only if fund fundamentals change — not because of market noise.

It’s actually a learning opportunity if approached correctly.

Short-term falls smooth out

Compounding takes over

Returns become more predictable

Even investors who started SIP before crashes ended up profitable if they stayed invested.

Start small if unsure

Increase gradually (Step-Up SIP)

📌 Rule of thumb:

Invest 20–30% of monthly surplus

Never invest money needed for emergencies

This is the most common fear.

Yes, your portfolio may show temporary loss

No, it does not mean SIP failed

📈 Falling markets = more units = higher future gains.

(When markets fall, SIP buys more units — which can improve your average cost over time, potentially enhancing long-term returns if markets recover)

The biggest mistake?

❌ Stopping SIP during downturns.

The right SIP strategy depends on you, not market headlines. Let’s discuss how to invest calmly and consistently, even when markets are volatile.

we help individuals and families build wealth through smart, goal-based investing. Whether you’re planning a secure retirement, your child’s education, or starting a SIP, we’re here to guide you

boopathi@flowersmfd.in

Keep me up to date with content, updates, and offers from FlowersMFD

We never spam – Unsubscribe anytime